Automatic Payments

- Intuitive and modern interface

- Pay each month on a specific date

- Pay via multiple payment methods

- Offer a range of convenient payment methods to cater to diverse preferences

- Enhance customer communication with proactive alerts on upcoming auto-payments

- Improve revenue collection and simplify account reconciliation for both you and your customers.

- Optimize cash flow management through automated, scheduled transactions.

- Seamlessly integrate into your existing business systems

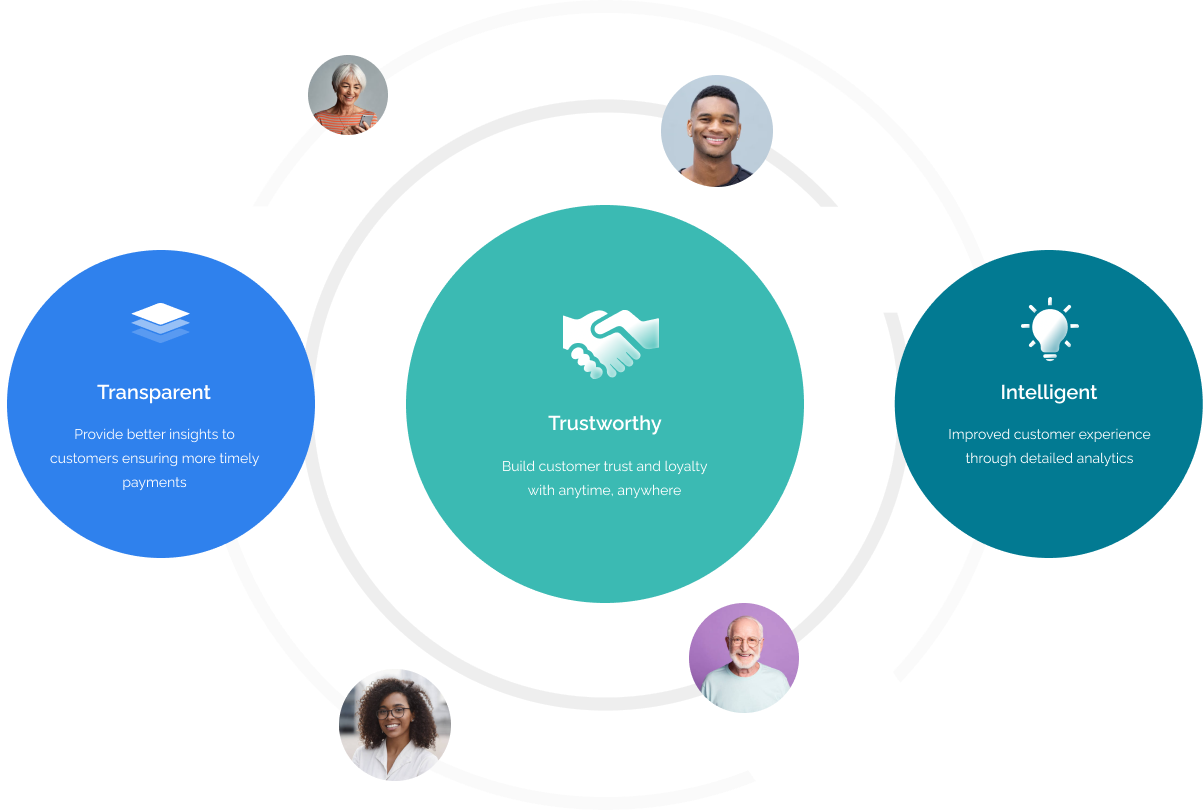

- Foster trust and loyalty by delivering consistent, dependable payment experiences.